If you’re paying for home insurance, you’ve probably wondered what actually lowers your premium, and no, bundling with your car insurance isn’t the only way. One of the smartest, most overlooked tactics? Installing security cameras can also help deter up to 53% of burglars as soon as they see them.

A well-placed camera system could help you score a real security camera insurance discount.

Many providers reward you for reducing risk, and cameras do exactly that by deterring break-ins, catching vandalism, and even helping resolve claims faster.

Depending on where you live and who insures you, home security insurance savings can range from a modest 2% up to a solid 20% off your annual premium. Most fall somewhere between 5% and 15%. If you’re looking for top-rated options to protect your property, check out this guide to the best security cameras for rental properties in 2025.

But not all systems qualify, and not all insurers treat them the same. So if you’re curious about how to get the best bang for your buck, and which cameras actually make a difference, you’re in the right place.

Table of Contents

- Key Takeaways

- How Insurance Companies Evaluate Security Systems

- Typical Insurance Discount Ranges by System Type

- 3 Common Misconceptions About Camera Insurance Discounts

- Maximizing Your Insurance Benefits

- Real-World Cost Analysis

- Professional vs. DIY Installation Considerations

- Integration With Smart Home Technology

- Preparing for Natural Disasters

- Choosing the Right System for Insurance Benefits

- Working With Insurance Companies

- Lowering Home Insurance Premiums With Security Cameras

- Frequently Asked Questions

Key Takeaways

- Professional monitoring carries more weight than DIY when it comes to securing a security camera insurance discount.

- Reliable documentation like alarm logs and verification reports supports your claim for home security insurance savings.

- Combining cameras with environmental sensors increases both safety and potential discount levels.

- Smart‑home integration such as automated locks and lighting further demonstrates risk reduction.

- Monitoring system continuity is essential, as lapses in service can cancel your reward.

- Installation method matters: professionally installed systems often secure higher discount tiers.

- Contact Batten today to explore systems tailored for long‑term home security insurance savings.

How Insurance Companies Evaluate Security Systems

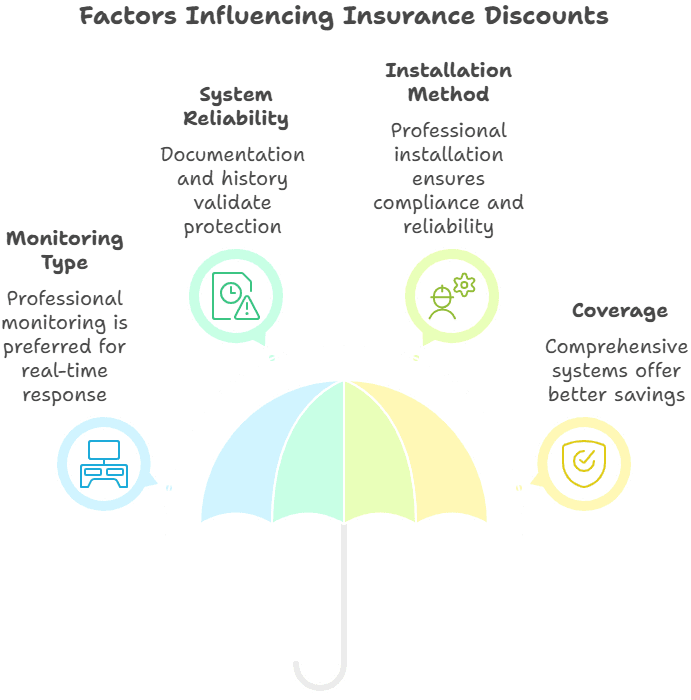

Not all security systems are treated the same when it comes to home insurance discounts. Insurers focus on three core factors: monitoring type, system reliability, and overall coverage. The more comprehensive and proactive your setup, the better your chances of qualifying for meaningful savings.

Monitoring Capabilities Matter Most

Insurance providers consistently prioritize professionally monitored systems over self-monitored options. A basic system with 24/7 monitoring from a licensed service often unlocks larger discounts than a premium setup that only sends push alerts to your phone.

Why? Because insurers want proof that someone is ready to act in real time, someone trained to verify alerts and contact emergency responders immediately.

System Reliability and Documentation

Insurance companies also value systems that can provide documentation, such as alarm history or verification reports. These details help validate claims and demonstrate that your home is actively protected. This is another reason professional monitoring carries weight, because it produces a clear paper trail.

Professional vs DIY Installation

How your system is installed can also influence your discount. Professionally installed setups are typically viewed as more reliable since they follow placement standards, ensure strong connectivity, and often comply with local codes.

That said, not all DIY systems are disqualified. Brands like Ring, SimpliSafe, and Arlo have earned a solid reputation for reliability and often qualify for security camera insurance discounts, especially when they include features like backup batteries, mobile access, and motion-triggered alerts.

In short, insurers reward systems that reduce risk in measurable ways. If your setup can prevent loss or shorten response times during emergencies, you’re far more likely to benefit from home security insurance savings.

Typical Insurance Discount Ranges by System Type

Insurance providers calculate your discount based on the type of system you install, the level of monitoring, and how many risks your setup can actively reduce. The more coverage your system provides, the higher your potential savings.

Basic Burglar Alarms vs Full-Spectrum Security Systems

Most insurance companies offer a 5-10% discount for homes equipped with basic burglar alarms that include professional monitoring. These systems cover the essentials, including door sensors, window triggers, and audible alarms. While helpful, they don’t address multiple threat types.

On the other hand, homes with advanced systems that include HD cameras, glass-break sensors, smart motion detectors, and 24/7 monitoring can qualify for 10-20% discounts. Insurers place a higher value on these setups because they reduce the chance of large-scale losses from theft, property damage, or even liability claims.

Visit Batten’s marketplace to find the best security cameras to lower home insurance rates.

The Power of Environmental Monitoring

Combining your security cameras with smoke detectors, carbon monoxide alarms, and water leak sensors opens the door to deeper home security insurance savings.

These systems tackle more than just burglary. They help prevent costly damage from fire, gas exposure, and floods. Because they reduce claims across several risk categories, insurers reward this level of protection with some of the highest discount tiers available.

For a closer look at how this plays out in real-world use, check out our SimpliSafe Smoke Detector Review for 2025.

Why Smart Home Integration Matters

Insurance companies are increasingly rewarding homeowners who use smart home technology to prevent accidents and intrusions.

Systems that include smart locks, lighting automation, and environmental sensors signal proactive safety and control. This kind of tech functions as a reliable risk-reducer when paired with professional monitoring and regular upkeep.

A well-maintained, fully integrated setup also positions you for some of the best security camera insurance discount rates available today.

3 Common Misconceptions About Camera Insurance Discounts

Security cameras can absolutely help cut your insurance costs, but only if you know how the discount system really works. Many homeowners make assumptions that cost them in the long run. Let’s clear up a few myths before they drain your savings.

1. Expensive Systems Don’t Guarantee Bigger Discounts

It’s easy to assume that spending more means saving more. But insurance companies don’t hand out extra perks just because your cameras came with a luxury price tag.

What they care about is risk reduction. That means a mid-range system with 24/7 professional monitoring and solid placement can often qualify for better insurance benefits than a high-end DIY setup with no external verification.

2. Security Discounts Aren’t Always Permanent

A lot of homeowners think their security system discount is a one-and-done reward. It’s not. Most insurance providers require proof that your system is still up and running, especially if it’s professionally monitored.

Miss a billing cycle or let the batteries die, and your insurer can pull the discount without warning. Regular checks and service continuity matter.

3. Security Systems Don’t Lower Deductibles

Security cameras may trim your monthly premium, but they don’t touch your deductible. That’s a separate part of your policy. If you experience theft or property damage, you’ll still pay the same deductible regardless of whether you have cameras or not. The main advantage is premium savings, not a lower payout during a claim.

Maximizing Your Insurance Benefits

To make your system work harder for you, focus on bundling features that reduce risk across multiple categories. Security setups that include intrusion detection, smoke alarms, CO2 sensors, and water leak alerts often qualify for layered discounts. This type of protection shows insurers you’re serious about preventing claims, not just documenting them.

Be sure to keep your system active and maintained. Insurers sometimes check system logs during policy renewals or claim investigations. A lapse in monitoring or dead devices can cost you both your discount and your credibility during the claims process.

Finally, talk to your insurance provider. Some companies only give full discounts for specific brands, monitoring services, or installation methods. Clarifying their requirements upfront can help you choose a setup that delivers maximum home security insurance savings.

Real-World Cost Analysis

For a typical homeowner paying $1,200 annually for insurance, a 10% security system discount saves $120 per year. If professional monitoring costs $300 annually, the net cost is $180, a reasonable price for comprehensive security protection.

Homes with higher insurance premiums see even better returns on investment, with some homeowners saving $200-400 annually on insurance alone.

The payback period for security system investments typically ranges from three to seven years when factoring in insurance savings, though this calculation doesn’t account for the intrinsic value of improved security and peace of mind.

Many homeowners find that the insurance savings make security systems more affordable while providing protection that extends well beyond financial benefits.

Geographic variations in insurance costs significantly impact the value proposition.

Homeowners in high-premium areas like California or Florida often see faster payback periods and larger absolute savings, while those in low-cost insurance markets may find that security systems provide more value through actual protection than insurance discounts.

Professional vs. DIY Installation Considerations

When it comes to insurance discounts, how your system is installed can be just as important as the hardware itself. Both professional and DIY installations can qualify, but the benefits and limitations differ.

Why Professional Installation Can Pay Off

Professional installation usually costs an extra $200 to $500 upfront. However, this added expense often leads to better discount eligibility.

Insurers tend to trust systems that are installed by licensed technicians because they’re more likely to comply with local codes, meet manufacturer standards, and be positioned for optimal performance. You’re not just paying for labor. You’re getting documentation, certification, and peace of mind during claims.

A professionally installed system also reduces the risk of setup errors that could compromise protection or void warranties. This reliability gives insurance companies more confidence, which is why some offer higher discount tiers for professionally installed setups.

What to Know About DIY Systems

DIY security systems have come a long way. Brands like SimpliSafe, Ring, and Arlo offer user-friendly setups that still qualify for insurance discounts, if installed properly.

The catch? You’re on the hook for everything: system configuration, placement accuracy, and providing proof of installation if your insurer asks for it.

To qualify for a discount, you’ll need to make sure your system meets your insurance provider’s criteria. That might include motion sensor coverage, entry point monitoring, and active professional oversight. Be sure to save invoices, user manuals, and monitoring agreements as documentation.

Integration With Smart Home Technology

Smart home compatibility is becoming a major factor in how insurers assess risk. The more connected and proactive your system is, the more value it offers, both in security and insurance savings. Before diving into the details, let’s look at the key areas insurers care about.

How Smart Features Add Value

Systems that sync with smart locks, environmental sensors, and automated lighting create layers of protection.

For example, motion-activated cameras that trigger exterior lights or security systems that automatically lock doors during an alarm show insurers that your setup doesn’t just alert, it acts.

These types of automated responses demonstrate proactive risk management. That means your system is working even when you’re not home, which reduces the chance of claims and boosts your eligibility for a security camera insurance discount.

Compatibility and Long-Term Benefits

Choosing a system that works with Amazon Alexa, Google Home, or Apple HomeKit makes future upgrades smoother and cheaper.

Insurers appreciate this adaptability because it increases the likelihood that homeowners will maintain and expand their systems over time. More coverage, more consistency, fewer claims, which is exactly what providers want to see.

If your goal is long-term home security insurance savings, it pays to think about more than just cameras. Focus on building a connected ecosystem that prevents problems before they start.

Preparing for Natural Disasters

Security cameras can do far more than deter intruders. When paired with environmental monitoring, they become powerful tools for protecting against natural disasters, and insurance companies are taking notice.

Environmental Monitoring Reduces Risk

Systems that include temperature sensors, water leak detectors, or smoke and carbon monoxide alarms help prevent costly damage before it spirals into a full claim.

These features are especially important in regions prone to floods, wildfires, or freezing temperatures. Insurance providers often reward this kind of proactive protection with additional discounts because it directly reduces their exposure to large losses.

Our comprehensive severe storm protection guide provides additional strategies for protecting your home during extreme weather events.

Backup Power and Cellular Connectivity

When disaster strikes, power and internet outages are common. That’s why battery backup and cellular communication are must-haves in vulnerable areas. These features keep your system active when it matters most.

Insurers place high value on continuous monitoring during high-risk situations, which can give you a competitive edge when applying for a security camera insurance discount.

Video Footage Strengthens Claims

Video documentation can be the difference between a smooth claim and a stressful one. Capturing pre-storm conditions or real-time damage offers proof that speeds up the process and clears up any disputes over when or how the damage occurred. This kind of evidence is especially useful for extreme weather claims, which can often get bogged down in red tape.

Choosing the Right System for Insurance Benefits

Not every system qualifies for top-tier discounts. To maximize your insurance benefits, it’s important to focus on features your provider actually values. Below are the criteria insurers typically care about most, and how to meet them.

Key Features That Drive Savings

Professional monitoring remains the gold standard. It shows insurers that someone is always ready to respond, which drastically reduces response time during emergencies.

Systems like the Ring 8-piece Alarm Security Kit include monitoring, motion detection, environmental sensors, and app control, all in a format that often meets insurers’ criteria for premium savings.

Also consider the total scope of coverage.

Homes with unique risk factors like pools, detached garages, home offices, or expensive collections may benefit from extra sensors or third-party integrations. Some insurers even offer specific discounts for monitoring these assets, so matching your setup to your home’s risk profile matters.

Long-Term Flexibility

Insurance requirements can change, and so can your home setup. Choose a platform that lets you expand, such as adding cameras, new zones, or smart home automation. Flexibility keeps your system compliant and makes sure you’re still eligible for discounts years from now.

Working With Insurance Companies

Even the best system won’t get you far without the proper paperwork. Insurance companies typically require proof of installation, monitoring service agreements, and occasionally an inspection or verification call before applying a discount.

Start the Process Early

Start the documentation process as soon as your policy begins. Waiting too long can result in pro-rated discounts or missed savings for that coverage year. Keep your records organized and ready to submit.

Ask About Additional Perks

Premium discounts aren’t the only benefit on the table. Some insurers offer lower deductibles for theft or vandalism claims if your home has an active monitored system.

Others prioritize your file during high-volume claim events like regional storms. These extra perks can save you time and money even if your premium discount is modest.

Keep Your Agent in the Loop

Upgrading to smart locks? Adding a water sensor in the basement? Let your insurance provider know. System improvements can affect your discount eligibility, and failing to report them might mean you’re leaving money on the table.

A quick email or phone call can unlock benefits that go beyond what’s advertised in your policy documents. Make it a habit to check in with your agent at least once a year or whenever you update your setup.

Lowering Home Insurance Premiums With Security Cameras

Installing security cameras can translate into meaningful home security insurance savings, reducing your premium by 5% to as much as 20%, depending on your system’s setup.

With professional monitoring, strong system documentation, and smart-home integration, you help insurers clearly see the lower risk your home represents. Environmental sensors further support protection against fire, flooding, or carbon monoxide.

That said, quality matters more than cost; mid-range systems with proper coverage often qualify for better security camera insurance discount rates than expensive yet misconfigured setups. Be proactive in maintaining your system and keeping documentation up‑to‑date.

By aligning your setup with what insurers value most, including continuous monitoring, backup power, and integrated sensors, you’re well on your way to unlocking both financial and safety benefits through home security insurance savings.

For comprehensive home protection beyond security cameras, consider browsing Batten’s expert-recommended home security tools and explore our full range of home security products designed to keep your family safe while potentially reducing insurance costs.

Frequently Asked Questions

How Do Insurers Value Professional Monitoring Versus DIY?

Insurers generally offer higher security camera insurance discounts for professionally monitored systems. These setups respond in real time and reduce risk more effectively than self-monitored alternatives. DIY systems can still qualify for home security insurance savings if they meet monitoring and documentation standards.

Can Adding Smoke or Water Sensors Boost Discounts?

Yes. Insurers reward homes that address multiple risks. Adding smoke detectors, carbon monoxide alarms, or water leak sensors to your camera setup can increase home security insurance savings significantly because these sensors prevent high-cost claims beyond burglary.

Does Smart-Home Automation Affect My Insurance Premium?

Smart-home features like automated lights, smart locks, and connected sensors demonstrate proactive risk control. These systems often qualify for better security camera insurance discounts because they reduce the likelihood and severity of incidents before they escalate.

Will Battery Backups Impact My Discount Eligibility?

Yes. Battery and cellular backups keep your system functional during outages or emergencies. Insurers favor systems that remain active in all conditions, which may result in higher home security insurance savings and better claims support.

Do Insurance Companies Require Annual Verification?

Some do. To keep your security camera insurance discount, you may need to confirm your system is still active and monitored. This could include updated service agreements or proof of ongoing connectivity. Skipping these checks could reduce your home security insurance savings.

Does Adding Cameras Lower My Deductible?

No. Security cameras only affect your premium, not your deductible. While you may pay less annually through a security camera insurance discount, the amount you’re responsible for in a claim typically remains the same unless your insurer offers additional perks.

What Documentation Should I Submit for a Discount?

To qualify, you’ll need to provide installation records, monitoring agreements, and possibly alarm logs. Keeping this documentation organized helps maintain your security camera insurance discount and shows insurers your system meets the requirements for long-term home security insurance savings.